what happens if my bank returned my tax refund

Wrong account information provided in your return so always double check your return. You can file your return and receive your refund without applying for a Refund Transfer.

No Tax Refund Yet Why Your Irs Money Might Be Late Cnet

If the direct deposit was directly from the IRS the bank would send it back to the IRS who would.

. Wrong account number on tax return. This will result in the bank rejecting the IRS. Once the financial institution recovers the funds and returns them to the IRS it can take up to 5 business days for the IRS to receive the funds back.

The return electronic transaction would go through the Treasury back to the. If you accidentally provide the government. When that bank refuses the direct deposit where it goes back to depends on where it was from.

Once the financial institution recovers the funds and returns them to the IRS it can take up to 5 business days for the IRS to receive the funds back. You can file your return and receive your refund without applying for a Refund Transfer. Why is the bank holding my tax return.

Once the IRS receives the. The IRS would fumble around with this for a bit. Since we have paid the refund into the bank account as nominated.

The receiving bank would reject the wire or ACH in a day or so. Login or Register on. What Happens If My Bank Rejected My Tax Refund.

You will have to submit a refund re-issue request in your Income-tax Departments website login and update your Correct or New bank Account Number. Banks are allowed up to 90 days from the date of the initial trace input to respond to. Answer 1 of 7.

Refund Transfer is a bank deposit product not a loan. That is after the irs receives the rejected deposit from Santa Barbara TPG. Payments you authorize from the account.

If wrong banking information is. For security reasons we cannot modify the routing number account number or the type of account from what was entered when you filed your return. If you refund is returned to the IRS the IRS will issue a mailed check to.

This allows the IRS to contact the bank on your behalf to attempt recovery of your refund. Its common to make a mistake when filling out important documents such as your tax returns. Called Santa Barbara TPG to ask for my rejected refund to be returned to the IRS on February 25.

How Can I Get Direct Deposit My Tax Refund Direct Deposited To My Green Dot Account Green Dot 1 Check Your Bank Account You May Have Received Your 2021 Tax Refund. In the event that your bank decides not to accept the deposit of your tax refund for whatever reason the monies will be. Once the IRS receives the.

In most circumstances where the refund is paid to a known bank account we are unable to retrieve the funds for you.

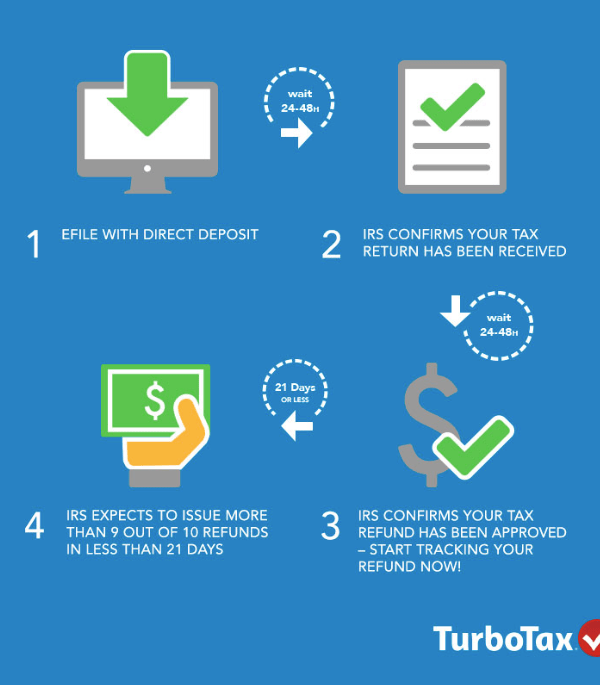

Where S My Tax Refund How To Check Your Refund Status The Turbotax Blog

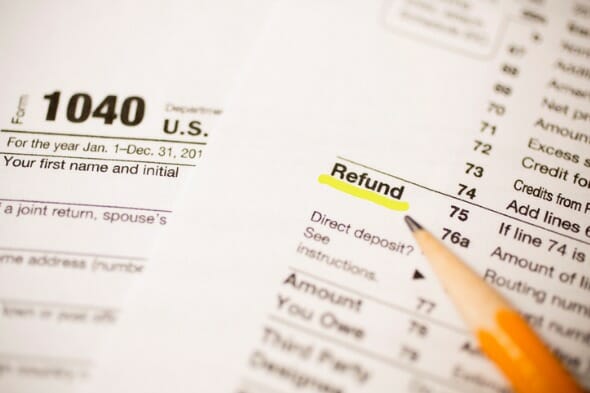

Claim Tax Refunds As Income On Tax Return

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Get Your Tax Refund With Chime Chime

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Where S My State Tax Refund Updated For 2022 Smartasset

How Long Does It Take To Get A Tax Refund Smartasset

Where S My Refund California H R Block

How To Fill Out A Fafsa Without A Tax Return H R Block

This Was The Average Tax Refund Last Filing Season Bankrate

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

What Happens To Your Tax Return During Bankruptcy

Tax Refund Status Is Still Being Processed

Quickest I Have Ever Got My Tax Return Filed 1 19 Recieved 1 20 Approved 1 26 And Refund Expected 1 28 R Irs

Where S My Refund Congratulations To Everyone That Got Approved Last Saturday Morning For A 3 18 2020 Direct Deposit Please Share The Date You Filed And Your Progress Below Facebook

5 Smart Ways To Invest Your Tax Refund Bankrate

Why Your Irs Refund Is Late This Year Forbes Advisor

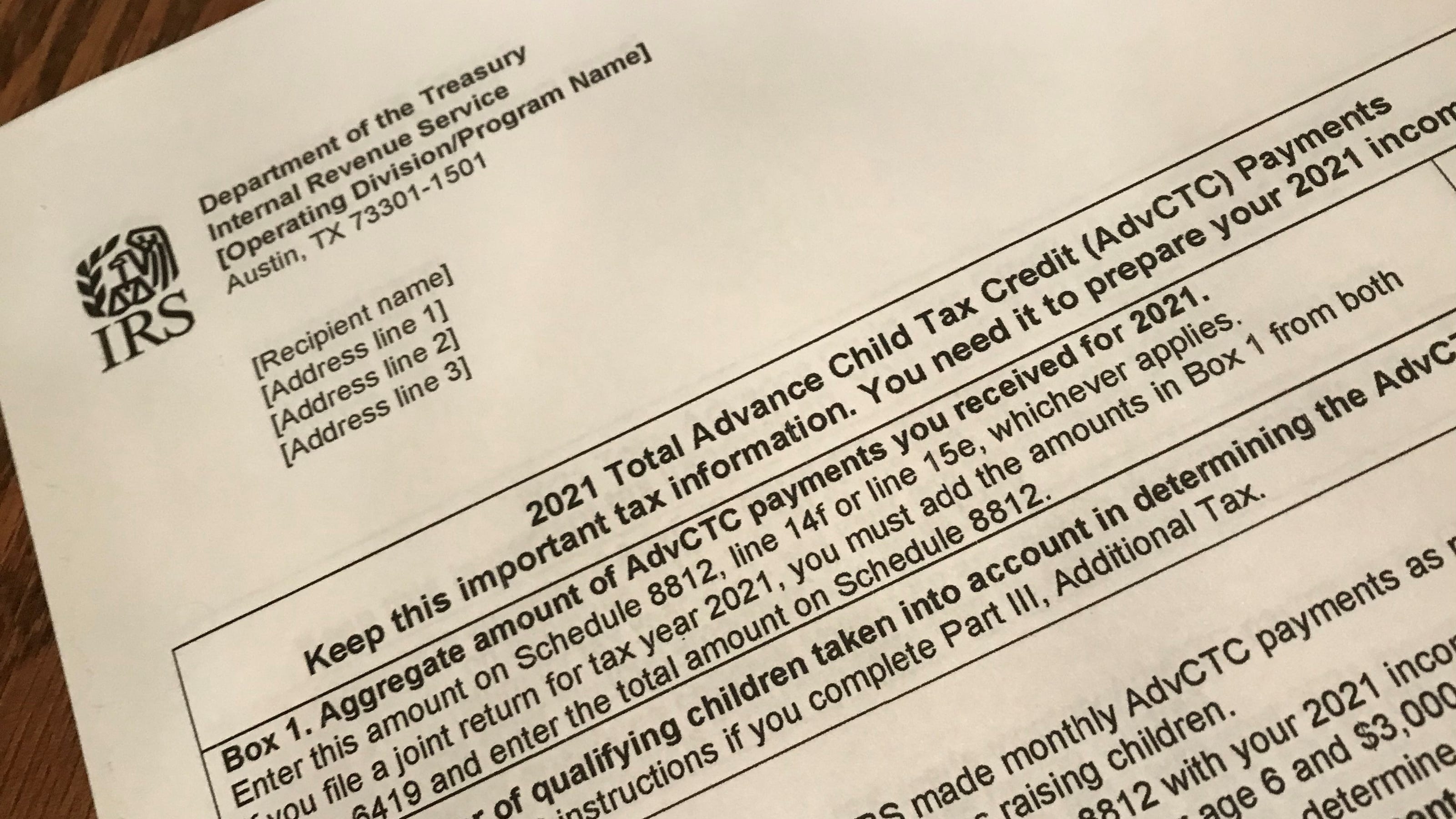

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Common Irs Where S My Refund Questions And Errors 2022 Update